On October 14, 2024, the Maharashtra Revenue and Forests Department issued Maharashtra Ordinance No. XII of 2024, which amends certain articles in Schedule I of the Maharashtra Stamp Act, 1958. This ordinance, titled the Maharashtra Stamp (Amendment) Ordinance, 2024, aims to increase state revenue and simplify business processes by revising stamp duty rates. The changes took effect immediately upon publication.

Key Amendments to the Maharashtra Stamp Act

Several articles of Schedule I were amended under this ordinance, raising stamp duty rates for specific instruments. Notable changes include:

- Article 4 (Affidavit): The stamp duty has increased from INR 100 to INR 500.

- Article 10 (Articles of Association of a Company): Stamp duty changed from 0.2% to 0.3% on share capital, with a maximum duty cap increase from INR 50 lakh to INR 1 crore.

- Article 63(a) (Works Contract): The base amount decreased from INR 10 lakh to INR 5 lakh, with the applicable stamp duty rate increasing to 0.3% for amounts over INR 5 lakh.

- Several other instruments, including counterparts, divorce instruments, and partnership deeds, now also carry an INR 500 stamp duty, up from INR 100.

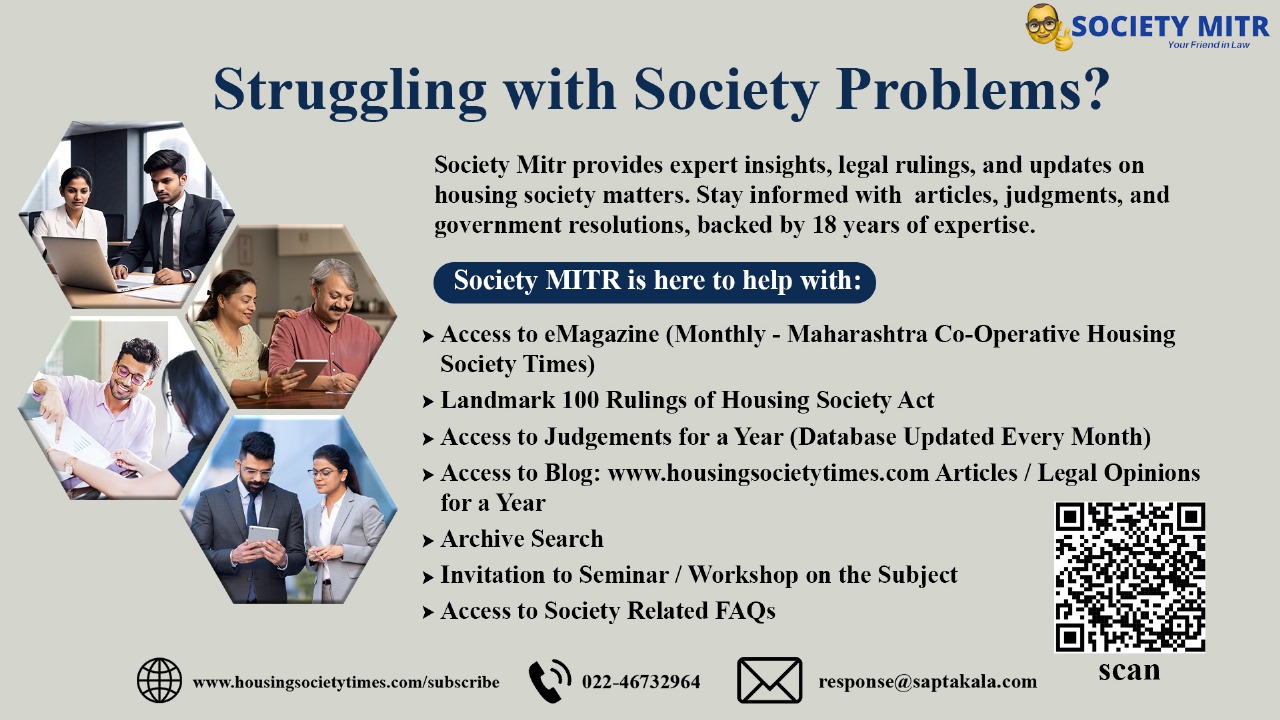

🌟 Looking for Landmark Judgments and Orders? 🌟

These revisions are expected to boost Maharashtra’s revenue by an estimated INR 100-150 crore annually while providing more clarity and flexibility in the state’s stamp duty structure.

Concessions for Metro III Project Affected Persons

The Maharashtra Cabinet has approved a stamp duty concession specifically for individuals affected by the Mumbai Metro III project. The concession applies to residents and tenants displaced due to the construction of the Girgaon and Kalbadevi stations. Eligible individuals will only need to pay a minimal stamp duty of INR 1,000 for property-related documents related to their rehabilitation, compared to the standard duty rates. This decision is aimed at easing the resettlement process and reducing the financial burden on affected individuals.

Accelerating Housing Projects on Salt Pan Lands

In an effort to expand affordable housing, the Cabinet also announced plans to transfer salt pan lands from the central government to the state for housing projects. These lands, located in areas like Kanjur, Bhandup, and Mulund, will be used for rental housing, slum rehabilitation, and other affordable housing schemes for economically disadvantaged residents. The Dharavi Rehabilitation Project will oversee the implementation of these housing schemes, while the Special Purpose Vehicle (SPV) will bear the cost of rehabilitation for existing residents on these lands.

Boosting State Revenue and Supporting Public Welfare

Through these measures, the Maharashtra government is striving to enhance revenue generation and streamline business processes. The updated stamp duty rates are part of a broader initiative to modernize the state’s revenue collection mechanisms and promote ease of doing business. Concurrently, the concession schemes for project-affected individuals and the development of salt pan lands underscore the government’s commitment to social welfare and affordable housing for all citizens.

These initiatives reflect Maharashtra’s efforts to balance fiscal responsibility with public welfare, fostering a business-friendly environment while addressing the housing needs of its residents.